Unified Lending Interface (ULI) :

Building the Future of Seamless Digital Lending

India’s lending landscape is at a decisive juncture. Despite sustained double-digit growth, nearly a significant portion of the population remains outside the ambit of formal credit. The gap isn’t only capital availability, it’s the lack of seamless, secure, and standardized access to lending infrastructure.

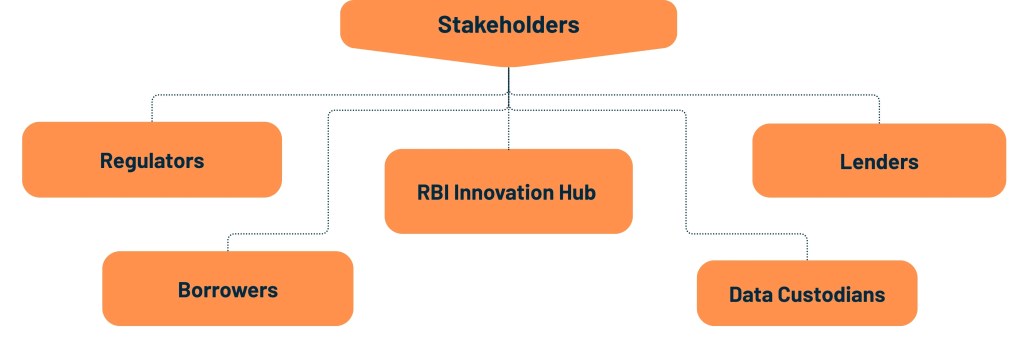

This is precisely the problem the Unified Lending Interface (ULI), an RBI Innovation Hub initiative, aims to solve. Much like UPI unified payments by standardizing transaction rails and APIs, ULI seeks to rewire lending by digitizing the complex processes of secured credit. Its mission is to create a unified, API-driven infrastructure that reduces friction, lowers costs, and expands access to credit across India.

Why Unified Lending Interface (ULI) is Technically Transformative

Unlike traditional integrations; fragmented, costly, and biased toward large lenders. ULI creates a common digital fabric with three fundamental strengths:

- Interoperable Infrastructure: A standardized set of APIs that connect lenders with data providers (credit bureaus, KYC registries, GST databases, and state land records).

- Consent-based Architecture: Where borrowers explicitly authorise access to their data from sources such as Aadhaar e-KYC, land records, GSTN, and DigiLocker, ensuring transparency and control

- Embedded Intelligence: Standardization of data enables lenders to plug in underwriting models, automate compliance checks, and scale decisioning.

Together, these features reduce latency in decision-making from weeks to minutes, significantly lowering acquisition costs.

Unified Lending Interface (ULI) in Action: Technical Use Cases

- Property & Land Records: Instant retrieval and validation of ownership, mortgage history, and encumbrances through direct integration with state registries.

- Digital KYC + GST Integration: API-first access to borrower financial health, validated in real time, enabling lenders to move away from fragmented manual processes.

- Hypothecation & Lien Creation: Seamless creation, registration, and release of liens across multiple jurisdictions—an innovation that brings secured lending on par with digital unsecured lending.

- Fraud & Duplication Detection: Cross-referencing of secured assets ensures the same property or collateral isn’t pledged multiple times.

Technical Preconditions

The complexity is vast. Lending is risk-driven and compliance-heavy. For ULI to succeed, three technical preconditions must be met:

- Standardization Across States: Harmonizing land record formats and digitization maturity levels across India.

- Reliability at Scale: Achieving a 99.99% uptime benchmark, akin to UPI, to build lender and borrower confidence.

- Public-Private Architecture: Leveraging fintech innovation for modular tools while ensuring RBI-driven governance and security.

The Trust Layer: Consent and Security by Design

ULI’s design prioritizes trust and transparency. Data becomes a shared raw material, but competitive advantage shifts from data ownership to intelligence on data how lenders underwrite, predict defaults, and personalize credit journeys.

The Road Ahead

Pilot programs are already underway; Digital Kisan Credit Cards, home loans, and micro-enterprise lending are early test beds (Axis Bank, Federal Bank, Union Bank of India, FinBox are some of the players in the pilot). If executed at scale, ULI could:

- Expand Credit Access: Bring rural and semi-urban borrowers with collateral but no digital access into formal finance.

- Lower Systemic Costs: Enable cooperative banks and NBFCs to compete with large incumbents by accessing the same infrastructure.

- Data Synergy: Seamless integration with UPI, e-mandates, and Account Aggregator systems to create end-to-end, compliant lending journeys.

Closing Perspective

Unified Lending Interface (ULI) is not just about digitization, it’s about re-architecting the very foundations of secured lending. By standardizing raw data access, enforcing consent-driven trust, and enabling embedded intelligence, ULI positions India’s credit ecosystem for scale, resilience, and inclusivity.

As one industry leader aptly put it: “Data should not be the differentiator. Intelligence on data should be.” ULI ensures that every institution from cooperative banks to fintechs can compete not on infrastructure access but on innovation and underwriting intelligence.